Investor Contact

Liza Heapes

+1 857-302-5663

ir@beigene.com

Media Contact

Kyle Blankenship

+1 667-351-5176

media@beigene.com

(BUSINESS WIRE) -- BeiGene, Ltd. (NASDAQ: BGNE; HKEX: 06160; SSE: 688235), a global oncology company, today reinforced its continued global expansion, rapid global and U.S. revenue growth, and innovative R&D strategy with the presentation of results from the fourth quarter and full year 2023 and business highlights.

“BeiGene made great progress in the fourth quarter and full year 2023 toward our goal to become an impactful next-generation oncology innovator. We have solidified our leadership in hematology with the continued success of BRUKINSA’s global launch, led by U.S. and Europe,” said John V. Oyler, Chairman, Co-Founder and CEO at BeiGene. “Our cost advantaged research and development and manufacturing have enabled us to build one of the largest and most exciting oncology pipelines in the industry. We look forward to a transformative year for BeiGene as we continue to deliver on operational excellence propelled by outstanding growth in revenue across new and existing geographies.”

Key Business and Pipeline Highlights

Product revenues for the quarter, $630.5 million, and full year, $2.2 billion, increased 86% and 75% from prior-year totals;

Disciplined management of operating expense growth drove operating loss decreases of 18% and 33% on a GAAP basis and 28% and 47% on an adjusted basis for the quarter and full year;

Solidified BRUKINSA’s position as a BTK inhibitor of choice with U.S. Food and Drug Administration (FDA) approval of a label update to include superior progression-free survival (PFS) results at a median follow up of 29.6 months from the Phase 3 ALPINE trial comparing BRUKINSA against IMBRUVICA® (ibrutinib) in previously treated patients with relapsed or refractory (R/R) chronic lymphocytic leukemia (CLL);

Expanded global label for BRUKINSA with European Commission approval for the treatment of adult patients with R/R follicular lymphoma (FL) who have received at least two prior systematic treatments, making it the first BTK inhibitor ever approved in this indication and the BTK inhibitor with the broadest label in the class;

Demonstrated leadership in hematology and strength of the Company’s pipeline with 25 abstracts presented at the American Society of Hematology (ASH) Annual Meeting in December, including:

Updated results from the ALPINE trial demonstrating sustained PFS superiority at a median follow up of 39 months for BRUKINSA against IMBRUVICA for the treatment of adult patients with R/R CLL;

Phase 1/2 trial data for sonrotoclax demonstrating safety and tolerability in combination with BRUKINSA with deep and durable responses in treatment-naïve CLL; promising single-agent activity in patients with R/R marginal zone lymphoma; and promising efficacy and safety in combination with dexamethasone in multiple myeloma (MM) with t(11,14); and

First-in-human data for BTK CDAC BGB-16673 demonstrating notable clinical responses and a tolerable safety profile in heavily pretreated patients with B-cell malignancies, including those with BTKi-resistant disease.

Expanded the global impact of anti-PD-1 antibody TEVIMBRA® (tislelizumab) with a positive opinion from the Committee for Medicinal Products for Human Use (CHMP) of the European Medicines Agency (EMA) recommending approval as a treatment for non-small cell lung cancer (NSCLC) across three indications, EMA acceptance of submission for the treatment of adult patients with first-line esophageal squamous cell carcinoma (ESCC), and regulatory reviews ongoing in 10 markets, including the U.S. and Europe; and

Advanced innovative R&D strategy by entering five New Molecular Entities (NMEs) into the clinic in 2023, including potential best-in-class CDK4 inhibitor BGB-43395.

Fourth Quarter and Full Year 2023 Financial Highlights

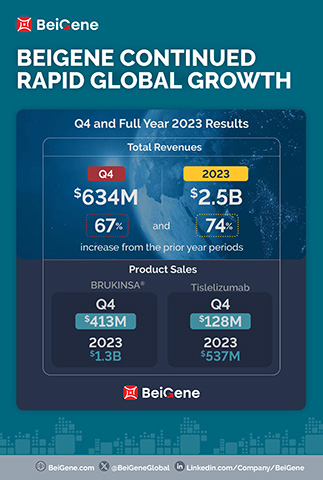

Revenue for the fourth quarter and full year 2023 was $634.4 million and $2.5 billion, respectively, compared to $380.1 million and $1.4 billion in the prior-year periods. The increase in total revenue in the quarter compared to the prior year is primarily attributable to product sales growth in the Company’s major markets. For the fourth quarter and full year 2023, the U.S. was the largest market the Company derived revenue from, with revenue of $313.2 million and $1.1 billion, respectively, compared to $155.4 million and $502.6 million in the prior-year periods. The Company expects this trend to continue in 2024 as U.S. sales of BRUKINSA continue to grow.

|

|

|

Three Months Ended December 31, |

|

Twelve Months Ended December 31, |

||||||||

|

(in thousands, except per share amounts) |

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Net product revenues |

|

$ |

630,526 |

|

$ |

339,022 |

|

$ |

2,189,852 |

|

$ |

1,254,612 |

|

Net revenue from collaborations |

|

$ |

3,883 |

|

$ |

41,073 |

|

$ |

268,927 |

|

$ |

161,309 |

|

Total Revenue |

|

$ |

634,409 |

|

$ |

380,095 |

|

$ |

2,458,779 |

|

$ |

1,415,921 |

|

|

|

|

|

|

|

|

|

|

||||

|

GAAP loss from operations |

|

$ |

(383,795) |

|

$ |

(468,622) |

|

$ |

(1,207,736) |

|

$ |

(1,789,665) |

|

Adjusted loss from operations* |

|

$ |

(267,224) |

|

$ |

(372,480) |

|

$ |

(752,473) |

|

$ |

(1,420,225) |

|

|

|

|

|

|

|

|

|

|

||||

|

* For an explanation of our use of non-GAAP financial measures, refer to the "Use of Non-GAAP Financial Measures" section later in this press release and for a reconciliation of each non-GAAP financial measure to the most comparable GAAP measures, see the table at the end of this press release. |

||||||||||||

Product Revenue totaled $630.5 million and $2.2 billion for the fourth quarter and full year 2023, respectively, compared to $339.0 million and $1.3 billion in the prior-year periods, and include:

Global sales of BRUKINSA of $413.0 million and $1.3 billion for the fourth quarter and full year 2023, respectively, compared to $176.1 million and $564.7 million in the prior-year periods;

Sales of tislelizumab of $128.0 million and $536.6 million for the fourth quarter and full year 2023, respectively, compared to $102.2 million and $422.9 million in the prior-year periods;

Sales of Amgen in-licensed products of $51.1 million and $188.3 million for the fourth quarter and full year 2023, respectively, compared to $27.7 million and $114.6 million in the prior-year periods.

Gross Margin as a percentage of global product sales for the fourth quarter and full year 2023 was 83.2% and 82.7%, respectively, compared to 78.3% and 77.2% in the prior-year periods. The gross margin percentage increased in both the quarter-over-quarter and year-over-year period due to a proportionally higher product sales mix of global BRUKINSA compared to other products in our portfolio and compared to lower margin in-licensed products, as well as lower costs per unit for both BRUKINSA and tislelizumab.

Operating Expenses

The following table summarizes operating expenses for the fourth quarter 2023 and 2022, respectively:

|

|

|

GAAP |

|

|

|

Non-GAAP |

|

|

||||||||

|

(in thousands, except percentages) |

|

Q4 2023 |

|

Q4 2022 |

|

% Change |

|

Q4 2023 |

|

Q4 2022 |

|

% Change |

||||

|

Research and development |

|

$ |

493,987 |

|

$ |

446,023 |

|

11 % |

|

$ |

437,383 |

|

$ |

404,186 |

|

8% |

|

Selling, general and administrative |

|

$ |

416,547 |

|

$ |

328,984 |

|

27 % |

|

$ |

361,435 |

|

$ |

275,648 |

|

31% |

|

Amortization(1) |

|

$ |

1,838 |

|

$ |

188 |

|

878 % |

|

$ |

— |

|

$ |

— |

|

NM |

|

Total operating expenses |

|

$ |

912,372 |

|

$ |

775,195 |

|

18 % |

|

$ |

798,818 |

|

$ |

679,834 |

|

18% |

The following table summarizes operating expenses for the full year 2023 and 2022, respectively:

|

|

|

GAAP |

|

|

|

Non-GAAP |

|

|

||||||||

|

(in thousands, except percentages) |

|

FY 2023 |

|

FY 2022 |

|

% Change |

|

FY 2023 |

|

FY 2022 |

|

% Change |

||||

|

Research and development |

|

$ |

1,778,594 |

|

$ |

1,640,508 |

|

8% |

|

$ |

1,558,960 |

|

$ |

1,474,919 |

|

6% |

|

Selling, general and administrative |

|

$ |

1,504,501 |

|

$ |

1,277,852 |

|

18% |

|

$ |

1,284,689 |

|

$ |

1,077,977 |

|

19% |

|

Amortization(1) |

|

$ |

3,500 |

|

$ |

751 |

|

366% |

|

$ |

— |

|

$ |

— |

|

NM |

|

Total operating expenses |

|

$ |

3,286,595 |

|

$ |

2,919,111 |

|

13% |

|

$ |

2,843,649 |

|

$ |

2,552,896 |

|

11% |

|

(1) Relates to BMS product distribution rights intangible asset that was fully amortized as of December 31, 2023, when the rights reverted back to BMS under the terms of the Settlement Agreement. |

||||||||||||||||

Research and Development (R&D) Expenses increased for the fourth quarter and full year 2023 compared to the prior-year periods on both a GAAP and adjusted basis primarily due to investing in new platforms/modalities to advance preclinical programs into the clinic and early clinical programs into late stage. Upfront fees related to in-process R&D for in-licensed assets totaled $31.8 million and $46.8 million in the fourth quarter and full year 2023, respectively, compared to $48.7 million and $68.7 million in the prior-year periods.

Selling, General and Administrative (SG&A) Expenses increased for the fourth quarter and full year 2023 compared to the prior-year periods on both a GAAP and adjusted basis due to continued investment in the global commercial launch of BRUKINSA primarily in the U.S. and Europe.

Net Loss

GAAP net loss improved for the fourth quarter and full year 2023, as compared to the prior-year periods, primarily attributable to reduced operating losses and the non-operating gain of $362.9 million related to the BMS arbitration settlement for full year 2023.

For the fourth quarter of 2023, net loss per share was $0.27 per share and $3.53 per ADS, compared to $0.33 per share and $4.29 per ADS in the prior-year period. Net loss for full year 2023 was $0.65 per share and $8.45 per ADS, compared to $1.49 per share and $19.43 per ADS in the prior-year period.

|

Cash, Cash Equivalents, and Restricted Cash |

||||

|

|

Year Ended December 31, |

|||

|

|

|

2023 |

|

2022 |

|

|

(in thousands) |

|||

|

Cash, cash equivalents and restricted cash at beginning of period |

$ |

3,875,037 |

$ |

4,382,887 |

|

Net cash used in operating activities |

|

(1,157,453) |

|

(1,496,619) |

|

Net cash provided by investing activities |

|

60,004 |

|

1,077,123 |

|

Net cash provided by (used in) financing activities |

|

416,478 |

|

(18,971) |

|

Net effect of foreign exchange rate changes |

|

(8,082) |

|

(69,383) |

|

Net decrease in cash, cash equivalents and restricted cash |

|

(689,053) |

|

(507,850) |

|

Cash, cash equivalents and restricted cash at end of period |

$ |

3,185,984 |

$ |

3,875,037 |

Cash Used in Operations in fourth quarter and full year 2023 was $221.6 million and $1.2 billion, respectively, compared to $318.2 million and $1.5 billion in the prior-year periods, driven by improved operating leverage.

For further details on BeiGene’s 2023 Financial Statements, please see BeiGene’s Annual Report on Form 10-K for the year of 2023 filed with the U.S. Securities and Exchange Commission.

Regulatory Progress and Development Programs

Key Highlights

Solidified BRUKINSA as a BTK inhibitor of choice with PFS superiority label update from the FDA, approvals in R/R FL in Europe and Canada

Expanded TEVIMBRA global reach with pending regulatory submissions in 10 markets, including the U.S. and Europe

Enrolled first patients in a Phase 3 global trial of sonrotoclax in first-line CLL and expansion cohorts with registration potential for BTK CDAC

|

Category |

Asset |

Recent Milestones |

|

Regulatory Approvals |

BRUKINSA |

|

|

TEVIMBRA |

|

|

|

Regulatory Submissions |

Tislelizumab |

|

|

Clinical Activities |

BRUKINSA |

|

|

Tislelizumab |

|

|

|

Sonrotoclax |

|

|

|

BTK CDAC |

|

|

|

Anti-LAG3 |

|

|

|

Early development

|

|

Anticipated Upcoming Milestones

Key Highlights

|

Category |

Asset |

Anticipated Milestones |

|

Anticipated Regulatory Approvals |

BRUKINSA |

|

|

Tislelizumab |

|

|

|

Anticipated Regulatory Submissions |

BRUKINSA |

|

|

Tislelizumab |

|

|

|

Zanidatamab2 |

|

|

|

Anticipated Clinical Activities |

Sonrotoclax |

|

|

Ociperlimab |

|

|

|

Tarlatamab3 |

|

|

|

Early development |

|

|

|

1 Leads Biolabs collaboration; BeiGene has commercial rights excluding China |

||

|

2 Jazz/Zymeworks collaboration; BeiGene has commercial rights in APAC (excluding Japan), Australia, New Zealand |

||

|

3 Amgen collaboration; BeiGene will have commercial rights in China and tiered mid-single digit royalties on net sales outside of China |

||

|

4 XmAb® is a registered trademark of Xencor, Inc. |

||

Manufacturing Operations

Neared completion of $800 million U.S. flagship biologics manufacturing and clinical R&D facility at the Princeton West Innovation Campus in Hopewell, New Jersey, which is expected to be operational in July 2024; the property has more than 1 million square feet of total developable real estate, allowing for future expansion;

Completed construction on new small molecule manufacturing campus in Suzhou, China. Phase 1 of construction added more than 559,000 square feet and expanded production capacity to 1 billion solid dosage form units annually; and

Completed construction of a 250,000-square-foot ADC production facility and additional 170,000-square-foot biologics clinical production capabilities at our state-of-the-art biologics facility in Guangzhou, China, which brings the total capacity to 65,000 liters.

Corporate Developments

Acquired an exclusive global license to a differentiated CDK2 inhibitor from Ensem Therapeutics, Inc., complementing the Company’s early development pipeline in breast cancer and other solid tumors.

|

Financial Summary |

|||||

|

Select Condensed Consolidated Balance Sheet Data (U.S. GAAP) |

|||||

|

(Amounts in thousands of U.S. Dollars) |

|||||

|

|

As of |

||||

|

|

December 31, |

|

December 31, |

||

|

|

|

2023 |

|

|

2022 |

|

|

(audited) |

||||

|

Assets: |

|

|

|

||

|

Cash, cash equivalents, restricted cash and short-term investments |

$ |

3,188,584 |

|

$ |

4,540,288 |

|

Accounts receivable, net |

|

358,027 |

|

|

173,168 |

|

Inventories, net |

|

416,122 |

|

|

282,346 |

|

Property, plant and equipment, net |

|

1,324,154 |

|

|

845,946 |

|

Total assets |

$ |

5,805,275 |

|

$ |

6,379,290 |

|

Liabilities and equity: |

|

|

|

||

|

Accounts payable |

$ |

315,111 |

|

$ |

294,781 |

|

Accrued expenses and other payables |

|

693,731 |

|

|

467,352 |

|

Deferred revenue |

|

300 |

|

|

255,887 |

|

R&D cost share liability |

|

238,666 |

|

|

293,960 |

|

Debt |

|

885,984 |

|

|

538,117 |

|

Total liabilities |

|

2,267,948 |

|

|

1,995,935 |

|

Total equity |

$ |

3,537,327 |

|

$ |

4,383,355 |

|

Condensed Consolidated Statements of Operations (U.S. GAAP) |

|||||||||||

|

(Amounts in thousands of U.S. dollars, except for shares, American Depositary Shares (ADSs), per share and per ADS data) |

|||||||||||

|

|

Three Months Ended December 31, |

|

Twelve Months Ended December 31, |

||||||||

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

(unaudited) |

|

(audited) |

||||||||

|

Revenue |

|

|

|

|

|

|

|

||||

|

Product revenue, net |

$ |

630,526 |

|

$ |

339,022 |

|

$ |

2,189,852 |

|

$ |

1,254,612 |

|

Collaboration revenue |

|

3,883 |

|

|

41,073 |

|

|

268,927 |

|

|

161,309 |

|

Total revenues |

|

634,409 |

|

|

380,095 |

|

|

2,458,779 |

|

|

1,415,921 |

|

Cost of sales - products |

|

105,832 |

|

|

73,522 |

|

|

379,920 |

|

|

286,475 |

|

Gross profit |

|

528,577 |

|

|

306,573 |

|

|

2,078,859 |

|

|

1,129,446 |

|

Operating expenses |

|

|

|

|

|

|

|

||||

|

Research and development |

|

493,987 |

|

|

446,023 |

|

|

1,778,594 |

|

|

1,640,508 |

|

Selling, general and administrative |

|

416,547 |

|

|

328,984 |

|

|

1,504,501 |

|

|

1,277,852 |

|

Amortization of intangible assets |

|

1,838 |

|

|

188 |

|

|

3,500 |

|

|

751 |

|

Total operating expenses |

|

912,372 |

|

|

775,195 |

|

|

3,286,595 |

|

|

2,919,111 |

|

Loss from operations |

|

(383,795) |

|

|

(468,622) |

|

|

(1,207,736) |

|

|

(1,789,665) |

|

Interest income, net |

|

16,274 |

|

|

18,219 |

|

|

74,009 |

|

|

52,480 |

|

Other income (expense), net |

|

16,749 |

|

|

19,438 |

|

|

307,891 |

|

|

(223,852) |

|

Loss before income taxes |

|

(350,772) |

|

|

(430,965) |

|

|

(825,836) |

|

|

(1,961,037) |

|

Income tax expense |

|

16,781 |

|

|

14,370 |

|

|

55,872 |

|

|

42,778 |

|

Net loss |

|

(367,553) |

|

|

(445,335) |

|

|

(881,708) |

|

|

(2,003,815) |

|

|

|

|

|

|

|

|

|

||||

|

Net loss per share |

$ |

(0.27) |

|

$ |

(0.33) |

|

$ |

(0.65) |

|

$ |

(1.49) |

|

Weighted-average shares outstanding—basic and diluted |

|

1,353,005,058 |

|

|

1,348,916,108 |

|

|

1,357,034,547 |

|

|

1,340,729,572 |

|

|

|

|

|

|

|

|

|

||||

|

Net loss per American Depositary Share (“ADS”) |

$ |

(3.53) |

|

$ |

(4.29) |

|

$ |

(8.45) |

|

$ |

(19.43) |

|

Weighted-average ADSs outstanding—basic and diluted |

|

104,077,312 |

|

|

103,762,778 |

|

|

104,387,273 |

|

|

103,133,044 |

Note Regarding Use of Non-GAAP Financial Measures

BeiGene provides certain non-GAAP financial measures, including Adjusted Operating Expenses and Adjusted Operating Loss and certain other non-GAAP income statement line items, each of which include adjustments to GAAP figures. These non-GAAP financial measures are intended to provide additional information on BeiGene’s operating performance. Adjustments to BeiGene’s GAAP figures exclude, as applicable, non-cash items such as share-based compensation, depreciation and amortization. Certain other special items or substantive events may also be included in the non-GAAP adjustments periodically when their magnitude is significant within the periods incurred. BeiGene maintains an established non-GAAP policy that guides the determination of what costs will be excluded in non-GAAP financial measures and the related protocols, controls and approval with respect to the use of such measures. BeiGene believes that these non-GAAP financial measures, when considered together with the GAAP figures, can enhance an overall understanding of BeiGene’s operating performance. The non-GAAP financial measures are included with the intent of providing investors with a more complete understanding of the Company’s historical and expected financial results and trends and to facilitate comparisons between periods and with respect to projected information. In addition, these non-GAAP financial measures are among the indicators BeiGene’s management uses for planning and forecasting purposes and measuring the Company’s performance. These non-GAAP financial measures should be considered in addition to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP. The non-GAAP financial measures used by the Company may be calculated differently from, and therefore may not be comparable to, non-GAAP financial measures used by other companies.

|

RECONCILIATION OF SELECTED GAAP MEASURES TO NON-GAAP MEASURES |

||||||||||||

|

(in thousands, except per share amounts) |

||||||||||||

|

(unaudited) |

||||||||||||

|

|

|

Three Months Ended December 31, |

|

Twelve Months Ended December 31, |

||||||||

|

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Reconciliation of GAAP to adjusted cost of sales - products: |

|

|

|

|

|

|

|

|

||||

|

GAAP cost of sales - products |

|

$ |

105,832 |

|

$ |

73,522 |

|

$ |

379,920 |

|

$ |

286,475 |

|

Less: Depreciation |

|

|

1,898 |

|

|

— |

|

|

8,578 |

|

|

— |

|

Less: Amortization of intangibles |

|

|

1,119 |

|

|

781 |

|

|

3,739 |

|

|

3,225 |

|

Adjusted cost of sales - products |

|

$ |

102,815 |

|

$ |

72,741 |

|

$ |

367,603 |

|

$ |

283,250 |

|

|

|

|

|

|

|

|

|

|

||||

|

Reconciliation of GAAP to adjusted research and development: |

|

|

|

|

|

|

|

|

||||

|

GAAP research and development |

|

$ |

493,987 |

|

$ |

446,023 |

|

$ |

1,778,594 |

|

$ |

1,640,508 |

|

Less: Share-based compensation expenses |

|

|

39,424 |

|

|

34,966 |

|

|

163,550 |

|

|

139,348 |

|

Less: Depreciation |

|

|

17,180 |

|

|

6,871 |

|

|

56,084 |

|

|

26,241 |

|

Adjusted research and development |

|

$ |

437,383 |

|

$ |

404,186 |

|

$ |

1,558,960 |

|

$ |

1,474,919 |

|

|

|

|

|

|

|

|

|

|

||||

|

Reconciliation of GAAP to adjusted selling, general and administrative: |

|

|

|

|

|

|

|

|

||||

|

GAAP selling, general and administrative |

|

$ |

416,547 |

|

$ |

328,984 |

|

$ |

1,504,501 |

|

$ |

1,277,852 |

|

Less: Share-based compensation expenses |

|

|

53,328 |

|

|

43,160 |

|

|

204,038 |

|

|

163,814 |

|

Less: Depreciation |

|

|

1,784 |

|

|

10,176 |

|

|

15,774 |

|

|

36,061 |

|

Adjusted selling, general and administrative |

|

$ |

361,435 |

|

$ |

275,648 |

|

$ |

1,284,689 |

|

$ |

1,077,977 |

|

|

|

|

|

|

|

|

|

|

||||

|

Reconciliation of GAAP to adjusted operating expenses |

|

|

|

|

|

|

|

|

||||

|

GAAP operating expenses |

|

|

912,372 |

|

|

775,195 |

|

|

3,286,595 |

|

|

2,919,111 |

|

Less: Share-based compensation expenses |

|

|

92,752 |

|

|

78,126 |

|

|

367,588 |

|

|

303,162 |

|

Less: Depreciation |

|

|

18,964 |

|

|

17,047 |

|

|

71,858 |

|

|

62,302 |

|

Less: Amortization of intangibles |

|

|

1,838 |

|

|

188 |

|

|

3,500 |

|

|

751 |

|

Adjusted operating expenses |

|

$ |

798,818 |

|

$ |

679,834 |

|

$ |

2,843,649 |

|

$ |

2,552,896 |

|

|

|

|

|

|

|

|

|

|

||||

|

Reconciliation of GAAP to adjusted loss from operations: |

|

|

|

|

|

|

|

|

||||

|

GAAP loss from operations |

|

$ |

(383,795) |

|

$ |

(468,622) |

|

$ |

(1,207,736) |

|

$ |

(1,789,665) |

|

Plus: Share-based compensation expenses |

|

|

92,752 |

|

|

78,126 |

|

|

367,588 |

|

|

303,162 |

|

Plus: Depreciation |

|

|

20,862 |

|

|

17,047 |

|

|

80,436 |

|

|

62,302 |

|

Plus: Amortization of intangibles |

|

|

2,957 |

|

|

969 |

|

|

7,239 |

|

|

3,976 |

|

Adjusted loss from operations |

|

$ |

(267,224) |

|

$ |

(372,480) |

|

$ |

(752,473) |

|

$ |

(1,420,225) |

|

|

|

|

|

|

|

|

|

|

||||

Please note that the figures presented above may not sum exactly due to rounding

About BeiGene

BeiGene is a global oncology company that is discovering and developing innovative treatments that are more affordable and accessible to cancer patients worldwide. With a broad portfolio, we are expediting development of our diverse pipeline of novel therapeutics through our internal capabilities and collaborations. We are committed to radically improving access to medicines for far more patients who need them. Our growing global team of more than 10,000 colleagues spans five continents, with administrative offices in Basel, Beijing, and Cambridge, U.S. To learn more about BeiGene, please visit www.beigene.com and follow us on LinkedIn and X (formerly known as Twitter).

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other federal securities laws, including statements regarding BeiGene’s progress towards becoming an impactful next-generation oncology innovator; the future of BeiGene’s oncology pipeline; BeiGene’s ability to grow revenue across new and existing geographies, particularly in the U.S.; the expected capacities and completion dates for the Company’s manufacturing facilities under construction and the potential for such facilities to increase manufacturing capabilities; BeiGene’s anticipated regulatory approvals, submissions and clinical activities; and BeiGene’s plans, commitments, aspirations and goals under the caption “About BeiGene”. Actual results may differ materially from those indicated in the forward-looking statements as a result of various important factors, including BeiGene’s ability to demonstrate the efficacy and safety of its drug candidates; the clinical results for its drug candidates, which may not support further development or marketing approval; actions of regulatory agencies, which may affect the initiation, timing and progress of clinical trials and marketing approval; BeiGene’s ability to achieve commercial success for its marketed medicines and drug candidates, if approved; BeiGene's ability to obtain and maintain protection of intellectual property for its medicines and technology; BeiGene’s reliance on third parties to conduct drug development, manufacturing, commercialization, and other services; BeiGene’s limited experience in obtaining regulatory approvals and commercializing pharmaceutical products; BeiGene’s ability to obtain additional funding for operations and to complete the development of its drug candidates and achieve and maintain profitability; and those risks more fully discussed in the section entitled “Risk Factors” in BeiGene’s most recent annual report on Form 10-K, as well as discussions of potential risks, uncertainties, and other important factors in BeiGene’s subsequent filings with the U.S. Securities and Exchange Commission. All information in this press release is as of the date of this press release, and BeiGene undertakes no duty to update such information unless required by law.

IMBRUVICA® is a registered trademark of Pharmacyclics LLC.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240226047170/en/

Investor Contact

Liza Heapes

+1 857-302-5663

ir@beigene.com

Media Contact

Kyle Blankenship

+1 667-351-5176

media@beigene.com